The seesaw effect

The professional indemnity insurance market is changing for construction-related professions.

Summary

After a few challenging years, the professional indemnity insurance market for construction-related professions is finally beginning to find solid ground. It's an encouraging sign of gradual recovery in light of a difficult recent period!

But first

Before we jump into the detail of where we are now, a quick lesson on the insurance market.

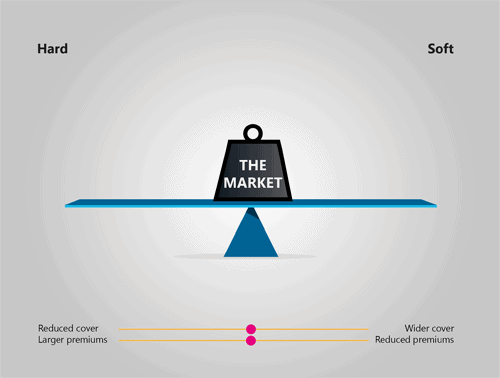

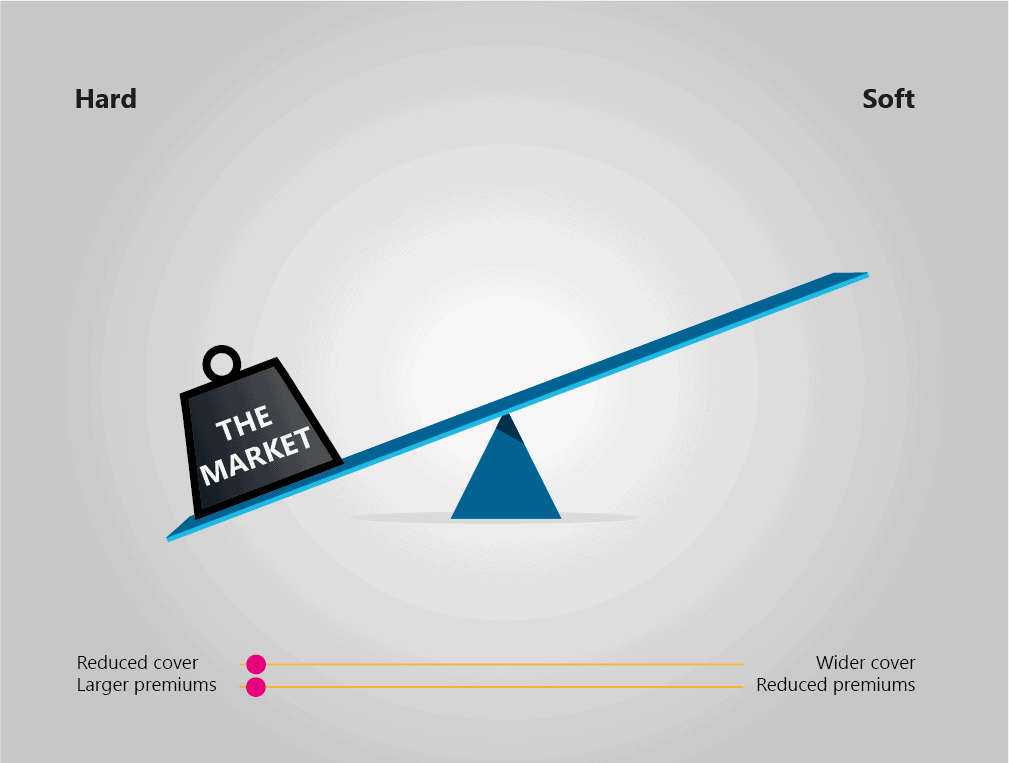

A lot of people talk about the insurance cycle, but in fact, it is like a seesaw. In an ideal world, the seesaw would be balanced all the time – with premiums and coverage remaining consistent.

The reality is it tips from one side and then the other.

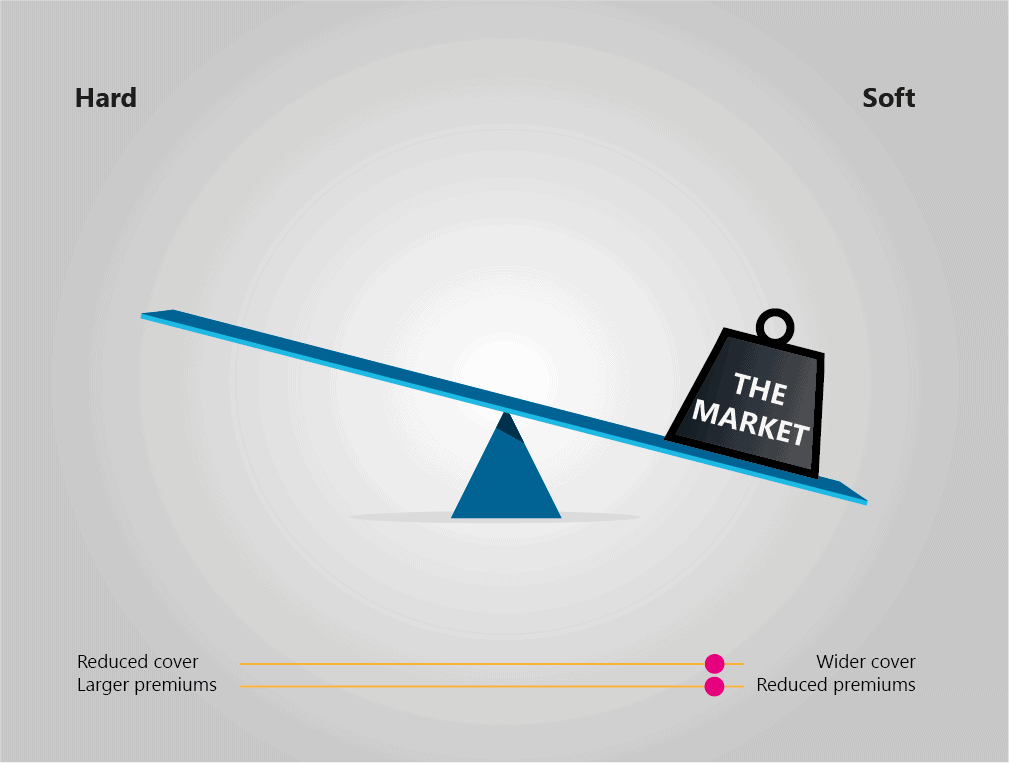

In a soft market, we see greater competition from insurers to win new business. This generally comes with falling rates and wider insurance coverage.

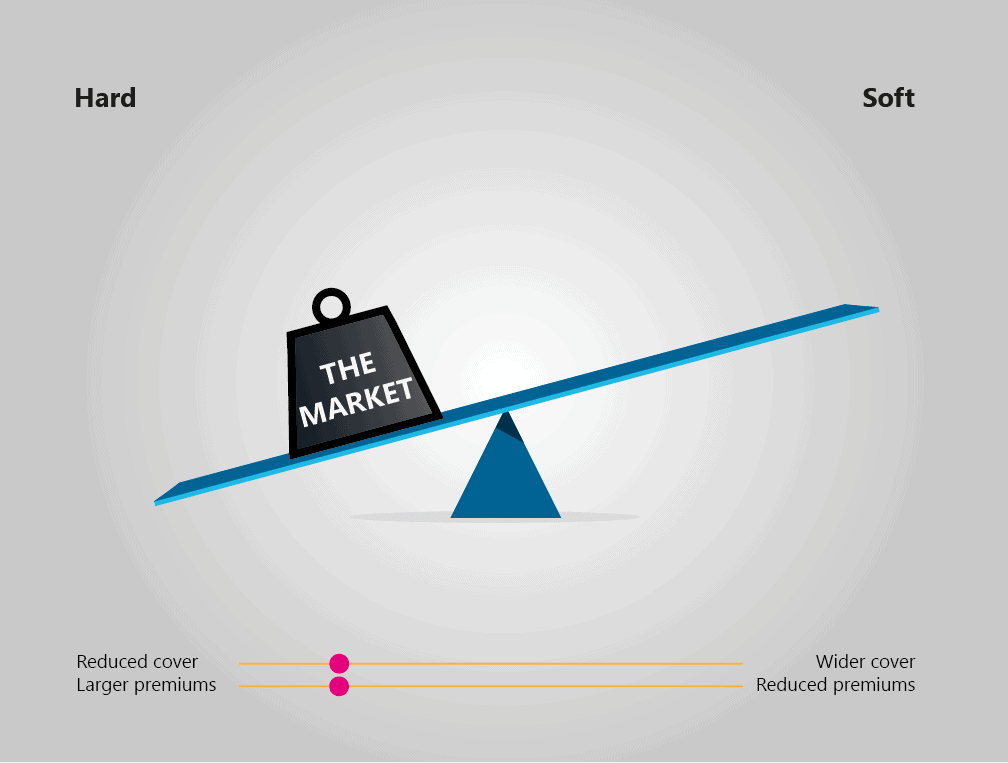

In a hard market, we see less competition from insurers and more emphasis on protecting their existing business. Rates typically increase and insurance coverage can narrow.

As the market starts to move, it is often tipped by an event or series of events that change the direction (or balance) of the market.

How did we get here: year-on-year premium increases and limited cover

Pre-2017 we were seeing a strong and resilient PI market with insurers being competitive. This soft market brought with it reduced rates and wider insurance coverage.

Whilst reduced premiums and wider coverage are attractive to the insured (you) it can mean the insurers take on more risk. The more risk they take on, the greater their exposure is to claims.

So what changed, and what effect did it have on the market?

Year: 2017

Market force: External

Event and market effect: The Grenfell tragedy caused the insurance market to react as it suddenly realised that insured businesses could be at risk of substantial claims.

Why was this an issue: The knock-on effect of sudden (unplanned) increases in claims or large claims values, is that they would lose money.

Consequence: The pre-emptive measure was to increase premiums to cover potential future losses. The cover started to be restricted.

Year: 2019

Market force: Internal

Event and market effect: Lloyds of London ordered a Professional Indemnity review.

Why was this an issue: The outcome of the review meant insurers had to move away from top-line growth in favour of underwriting for profit due to substantial losses. This led to significantly reduced cover, increased rates and removing underperforming businesses, ultimately reducing capacity in the market. For businesses they kept on the books, premiums increased.

Consequence: We swiftly moved into a ‘hard market’ with increasing premiums, delays in servicing and insurers looking to protect what they had and remove unattractive risks. Greater pressure was placed on businesses and insurance brokers to prove they had a solid company, with the right risk management strategies.

Year: 2020

Market force: Internal

Event and market effect: The Covid-19 pandemic hit, with businesses facing massive uncertainty and financial pressures.

Why was this an issue: The future viability of businesses became an issue, with insurers wondering if premiums would be paid, or that businesses would take on unsuitable projects to stay afloat. Insurer performance and servicing suffered.

Consequence: Businesses had to provide more information as more focus is placed on the insurance broker presentation.

Where are we now? Current market conditions…

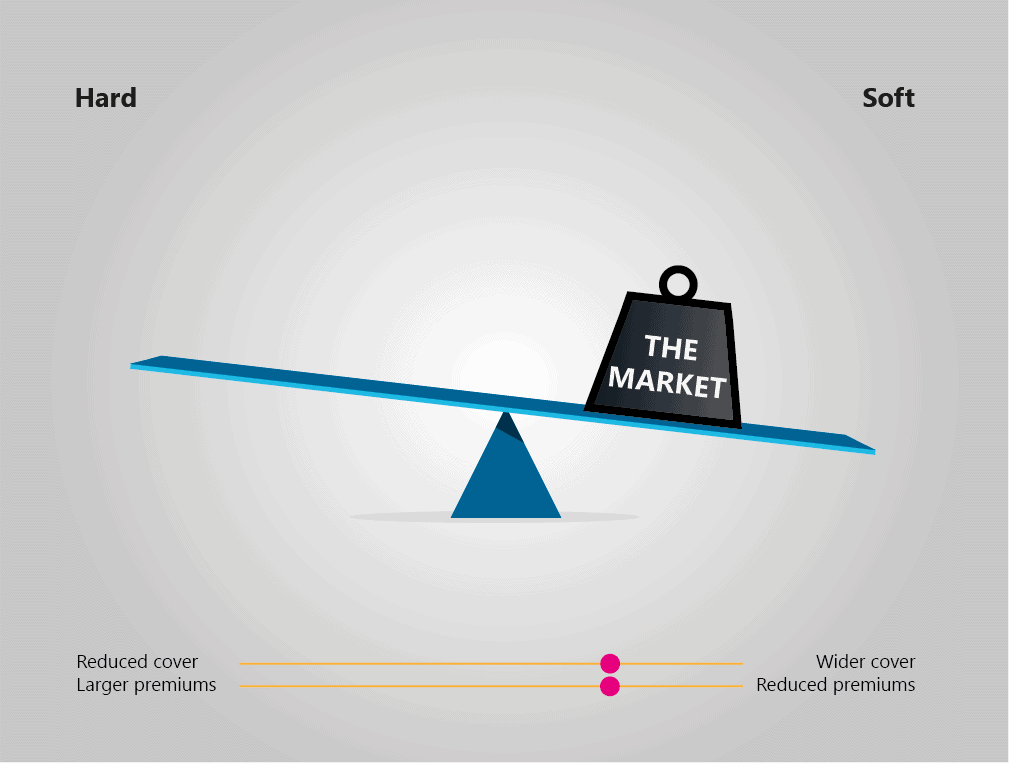

The great news is that the professional indemnity market appears to be stabilising, with most insurers on a path of recovery - but there is still a way to go.

Having navigated our clients through this period we are seeing rates become more manageable than in previous years, along with insurers being open to discuss and consider the coverage that is achievable for many firms again.

It remains uncertain if rates will reduce to the levels they were before the hardening of the market (pre-2017), but current indications are positive.

Differing opinions…

Fire safety regulations and cladding have been causing major headaches for firms in the industry. To help protect its members, RICS has stepped up to the plate and required insurers to provide a minimum of £1m aggregate cover on properties that are four stories or fewer.

However, not all insurance providers agree with this stance.

The silver lining is, insurers are open to discussions around offering limited coverage moving forward but unfortunately nothing much can be done about past projects, yet...

Achieving the best premium and cover for your firm

Whilst insurance ratings are starting to stabilise, I believe the greater focus on your business presentation will remain, and those that do a better job will be rewarded with an insurer who is more willing to talk, and provide competitive premium and coverage benefits.

Here are our top tips for better outcomes

Working with an experienced, specialist broker

To receive the best outcome, it is essential to decide which broker you want to act on your behalf.

Not everyone will have experienced the changing market conditions. You should research and choose the broker with the right credentials, whom you want to work with, and who you are happy will represent you.

The role of your broker is to support you and strengthen the presentation of your business to insurers so that you are more likely to receive the most competitive premiums on offer.The right broker can do this by listening to your needs, liaising, discussing and negotiating with the right insurers that have the appetite for your profession and your activities.

Be prepared to show your business in the best light possible

Demonstrate your risk management procedures and any changes you have made to improve the risk management in your business.

Write an overview of the last 12 months and a general outlook for the forthcoming year.

Many firms pay for their insurance in instalments, ensure you have your accounts ready to ensure there are no delays and additional stress. Insurers are still concerned about the financial viability of the firms they cover.

Don’t flog yourself to the market

Having too many brokers representing your business to the market doesn’t get the best results for you. Whilst it doesn’t shine a positive light on you or your business, in practical terms you’ll need to spend more time talking to multiple brokers, whilst insurers will have a difficult time managing this scenario too.

Insurers do not want your insurance broker to act as a post box and neither do you.

Where to go from here?

As I said, we are seeing signs of market and premium stabilisation along with an increase in insurer appetite. I wouldn’t say we are entering a soft market, but we are seeing the market tip in the other direction.

Brokers, like MFL, who weathered the storm, supported our clients and have experienced these changing conditions before, are perfectly placed to review and obtain an alternative quotation to ensure you are getting the best coverage available, in light of the changing market conditions.

By Julia Whittle, Development Director - Professions